Blockchain within Payments

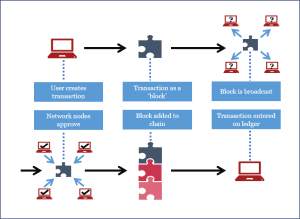

Blockchain technology allows banks to store, access and update data in a secure digital ledger. This makes it easier for multiple parties to view and share information, eliminating the need to manually reconcile data across multiple databases. It isn’t simple to transmit cash from one bank to another or from one country to another. Blockchain technology offers a secure and cost-effective payment method, reduces the need for third-party verification, and shortens the processing time of traditional bank transfers. Blockchain-enabled cross-border payments can be completed in minutes instead of days and are a fraction of the costs typically associated with international payments. Additionally, blockchain encryption ensures an extra layer of security compared to traditional payment platforms.

Banks can utilize cutting-edge advances to empower speedier installments by building a decentralized channel (cryptocurrencies). For example, cryptocurrencies serve as digital money and as a method of payment around the world. This way, transactions are done within seconds and more securely. Banks can therefore address the inefficiencies of the current system simply by offering cryptocurrency options to their customers.

Blockchain innovation can possibly speed up installment forms whereas moreover bringing down costs. Banks can minimize the request for third-party confirmation by utilizing blockchain. By setting up a decentralized record for installments (e.g., Bitcoin), blockchain innovation may encourage quicker installments at lower expenses than banks.

By establishing a decentralized ledger for payments (e.g., Bitcoin), blockchain technology could facilitate faster payments at lower fees than banks. 90% of members of the European Payments Council believe blockchain technology will fundamentally change the industry by 2025.

Examples of improved payment system through blockchain

When it comes to payments, cryptocurrencies are far from fully replacing fiat currencies (such as the US dollar), but trading volumes of cryptocurrencies such as Bitcoin and Ethereum have increased mainly in recent years. In fact, the Ethereum network was the first network in which he processed $1 trillion worth of transactions in the 2020 calendar year.

Several companies are using blockchain technology to improve B2B payments in developing countries. One example is BitPesa, which enables blockchain-based payments in countries such as Kenya, Nigeria and Uganda. The company processes millions of dollars worth of transactions and is reported to have grown 20% month over month.

BitPesa is also widely used to transfer funds sent throughout Sub-Saharan Africa, the most expensive sending region in the world. Cryptocurrency payment platforms like BitPesa have reduced transfer fees by more than 90% in the region.

Blockchain companies are also working hard to enable businesses to accept cryptocurrencies as payment. For example, BitPay, a payment processor that helps merchants accept and store Bitcoin payments, has many integrations with e-commerce platforms such as Shopify and WooCommerce. In 2022, we announced support for DoorDash and Uber Eats payments. To pay for the meal, the cryptocurrency owner has three different payment options. Buy an Uber Eats or DoorDash gift card with your crypto wallet, pay with a BitPay card, or order from Menufy or Takeaway.com that accept direct cryptocurrency payments.

Ethereum-based installments platform AirFox, which was obtained by Brazil-based retailer Through Varejo in May 2020, joined forces with MasterCard to permit clients to pay utilizing its banQi app at worldwide focuses of deal, as well as at each By means of Varejo area.

HUPAYX, a South Korea-based crypto installments startup, joined forces with a few South Korean businesses in 2019 to make an installments arrange. At the time, this empowered shoppers to pay utilizing the HUPAYX versatile app and point-of-sale framework at over 400,000 stores, counting duty-free stores and shopping complexes.

In the payroll space, companies like Bitwage and PaymentX are enabling companies to pay their employees in cryptocurrencies. When an employer transfers a salary to a crypto payroll provider, the latter automatically converts it from fiat to crypto and makes it available in the employee’s crypto wallet. While crypto payrolls are attractive to all businesses looking to attract workers with innovative salary options, they are especially beneficial to organizations with a global workforce as they are faster and cheaper compared to wire transfers. .

Blockchain technology is also used to enable micropayments, usually under $1. For example, SatoshiPay, an online cryptocurrency wallet, allows users to pay a small amount to access premium online content on a pay-per-view basis. Users can fund their wallets with Bitcoin, USD, or any other payment token supported by the app.

A major factor driving imminent disruption to the payments industry is the fact that the infrastructure that supports it is as vulnerable to disruption as the world of billing and processing.